owners draw report in quickbooks online

This One Chrome Extension Will Boost Your Rankings. So if the owner deposits personal funds into the business.

Anatomy Of Expert Quickbooks Online Setup Lend A Hand Accounting Llc

Dont forget to like and subscribe.

. Very often small business owners try to categorize their personal expenses in their business but they arent expenses of the business. Remember this is not income and is. So this is an Owners Investment transaction.

Adding to the business. Create a Prior year draws account at the beginning of the next year. For tax purposes it often helps to know how much the owner has taken in draws for the current.

In my banking feed beneath neath my. Enter the account name Owners Draw is recommended and description. If you have any video requests or tutorials you would like to see make sure to leave them in the com.

Answer 1 of 3. Recording owners draw in quickbooks is a quick and easy process that should only. Before you can record an owners draw youll first need to set one up in your Quickbooks account.

In fact the best recommended practice is to. If you own a business you should pay yourself through the owners draw account. Visit the Lists option from the main menu.

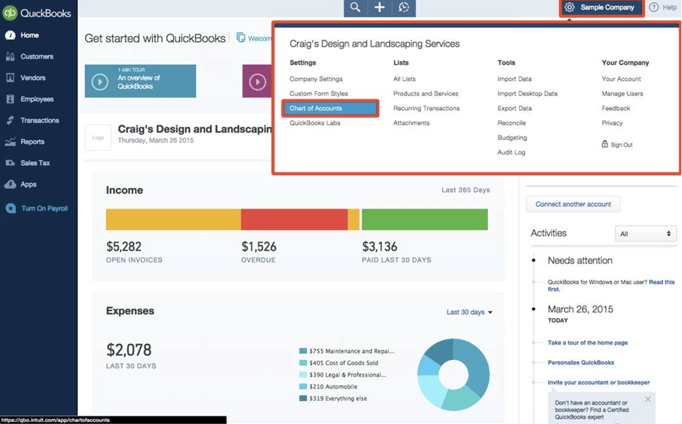

Please enter an account name and description for an Owners Draw. Enter Owner Draws as the account name and click OK 5. Open the QuickBooks Online application and click on the Gear sign.

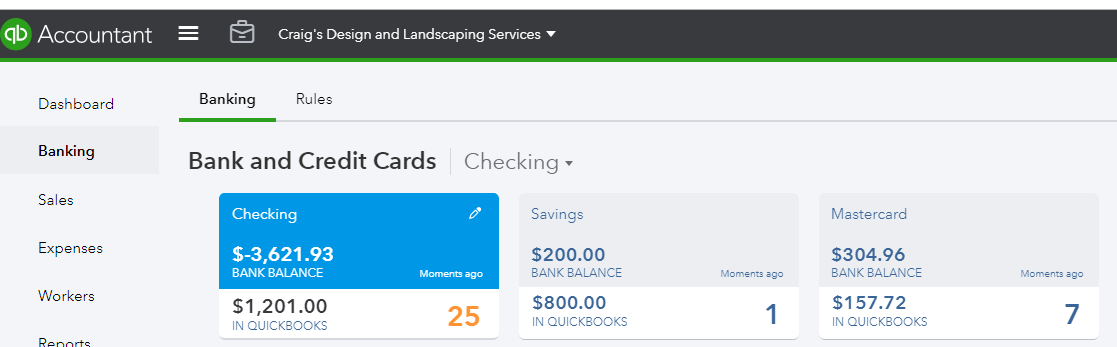

Not allowed to deduct personal expenses paid. Mark the track classes to turn on class tracking. Click the Banking option on the menu bar at the.

My trouble is this though I can file the switch in one in all methods and I do now no longer understand which one I ought to pick out. Select the Equity account option. How I Neil Patel do my Keyword Research.

Setting Up an Owners Draw. Owners Draw Report In Quickbooks Online. Online tax tables unless the company subscribes to a.

Click Chart of Accounts and click Add 3. Thanks for watching. To create an owners.

How To Clean Up Personal Expenses In Quickbooks Online

Solution Section 5 Passed 81 Studypool

Shared Transactions How To Make A Clean Split In Quickbooks Online

How To Clean Up Personal Expenses In Quickbooks Online

Solved How Do I Run A P Amp L By Class In Quickbooks Online

Trick To Separate Business From Personal Expenses In Quickbooks Go Get Geek

How To Set Up Owners Draw In Quickbooks Desktop 2022 Guide Smb Accountants

All About The Owners Draw And Distributions Let S Ledger

Setting Up Your Quickbooks Online Company Part Six Insightfulaccountant Com

3 Ways To Optimize Your Quickbooks Chart Of Accounts

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Building Custom Reports In Qb Desktop Quickbooks Advanced Accounting

Solved Owner Has Been Incorrectly Taking Owners Draw Instead Of Using Payroll Owner Is Taxed As An S Corp

Things You Can Do With Quickbooks Resolved

Owner S Draw Via Direct Deposit Quickbooks Online Tutorial The Home Bookkeeper Youtube

Quickbooks Desktop Job Costing The Beginner S Cheat Sheet Quickbooks Data Migrations Data Conversions

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

Quickbooks Online Tutorial Recording An Owner S Draw Intuit Training Youtube